Financial Aid Fraud. We’re at a tipping point and things are about to explode. The reality is, FSA fraud is a $6B problem annually and it’s happening in your institution. Consider this:

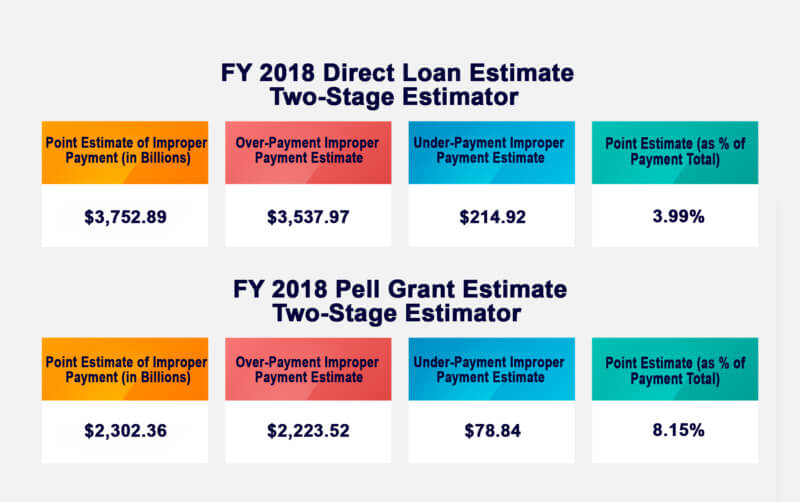

The Department of Education shows that 3.99% and 8.15% of Direct loans and Pell grants respectively are part of “improper payments” paid out annually. Several reasons exist for this but the one that hurts you most is “straw student” fraud. The Dept of Education has been dealing with 100’s of fraud rings since 2011 and has been warning institutions about this near epidemic.1

This Fraud adds up to $6B in 2018 as the chart below shows2

WANT TO SAVE $100,000’s OR EVEN A $1Million dollars?

Maybe you can – keep reading.

You can’t stop paying the students their direct loans and Pell Grants as you depend on this money, but you MUST manage it better! Here’s what your institution should be on the lookout for.

There are two identified types of FSA fraud 3. Financial aid scammers and Financial aid fraud rings. In the first instance, you can have a single student who is not interested in obtaining an educational outcome and who is only interested in obtaining FSA funds. Then you have the fraud ring who is the most dangerous to your institution. It involves a ring leader who may create up to hundreds of “straw or fictitious “students and pays people for using their identity or steals identities through any of the web sites who offer complete information on others who may not become aware for years that they applied for loans or grants.

Let’s Become a Straw Student.

How easy is it to become/create a student identity and obtain funding?

- First, obtain full information on your straw students from any of the sites available for people identity for sale

- Or ask others to use their information and offer them some money

- Make FSA applications using this information

- Target low tuition schools with lower costs than financial aid benefits (i.e. ring leader may pay the $1,000.00 tuition and keep the balance of say $4,500.00)

- Target schools who have online classes and applications that require no proof of identity in an application or program completion and low entrance requirement.

- Perform the least amount of work so you outlast the “you are dropped date” and get the balance of your loan or grant money reimbursed.

- Run-away since you now have money, a fictitious address and email that you promptly cancel.

- OR stay in the school receive grade “F” and try the course you failed again and receive more FSA. (it pays to fail).

- The feds will come knocking and ask about the money you owe them for these students who were dropped but were paid and according to your “partnership program agreement” you signed you must pay back these monies.

- Oh by the way you also lost money since your online class accepts only 30 and maybe 3-5 were straw students who took seats from real students and since they now owe you tuition payback you are out of luck.

- Multiple this by 800 (largest ring we have heard about) and voila ring leader just made $3.6M and became part of the $6B improper payments the Department of Education says is going on annually

This is a simplified version, but it shows how easy it can be to obtain funding. Now what you don’t see is how they manage to stay in these classes from enrollment to payout day? How do they do this?

It is technology. A quick Google search will provide you with ways you can thwart the system. For a small fee, you can get software that takes a paragraph and creates new words in a language mixer and pops out an entire new paragraph that avoids plagiarism citation. The words may sound like your command of the English language are limited but it’s enough to show participation and who knows maybe even get a passing grade!

Participation is the key to success with straw students or individual scammers.

What are some signs of scammers?

Here are a few quick tips:

- Look for minimal attendance or minimal online logins meant to give an appearance of activity

- Look for minimal concern for grades; even a failing grade is acceptable

- They don’t complain if called out for plagiarism or cheating! It’s uncommon to NOT complain.

- Know that cheating for the ring is usually rotated amongst straw students, so they keep taking one for the team, so others continue to get better marks. This is an attempt to be less obvious to faculty who may raise a red flag if there’s always consistent “F’s”

Think your school is not involved? Ask your CFO how much tuition reimbursement is paid back to the feds last year and how much are you writing off for non-payment of student loans? Why did the OIG Dep. of Education perform a random audit and found: “The 8 schools chosen disbursed nearly $222 million to more than 42,000 distance education students who did not earn any credits during a payment period”? They were not happy and that’s when they tied continued Title IV funding to student ID verification to get institutions to manage FSA funds better4.

Here are some real activities reported by the press: Note the OIG keeps a running record of all FSA fraud in their website https://www2.ed.gov/about/offices/list/oig/ireports.html

- School pays back $9.5M from students “Milking the System” with FSA and now they are gone

- “The ring leaders used the identities of at least 20 people, logging themselves into online courses as “straw students,” Now they have to pay over $417,000 in restitution for running a student financial aid fraud ring”

- Schools must pay back $14M in improper payments

- Union head at college laments losing 19 new hires due to improper payments payback

- A ring leader agreed to repay over $581,000 for money obtained through Stafford loans and Pell grants and to maintain records of 136 “straw” students

What you can do about this fraud?

Get some help! Like most schools, you are probably not set up to review patterns and look for red flags and besides you may also outsource most of the management of FSA dispersing to third parties who have little interest in finding fraud. Remember your name is on the Partnership Program Agreement.

You might want to reach for help from BioSig-ID. This technology verifies student ID (a must to determine FSA OR academic fraud). BioSig-ID is the World’s only biometric password you DRAW. It blends amazing biometric technology using the password format we are all comfortable with. The simple change from a typed password to a 4 character DRAWN password, is ultra-security that allows BioSig-ID to analyze ID so only the legitimate user gets access. PLUS with its award-winning machine learning forensics, it searches for patterns that catch and details fraudsters. BOTH Academic and FSA fraud. Here’s more.

Here are some of the ways BioSig-ID helps you with FSA Fraud

- You must be able to verify the identity of the students to monitor their activity

- If the ring leader is using the same password for all straw students, we will know it

- We know what IP location, what browser, what device, what computer is used to log in

- With our new revolutionary machine learning we know if the same person is creating all the passwords because we analyze how they draw their password (part of our patents)

- We also look at patterns over time and find the students who have low or no participation and with your help find out if these students are getting grade “f”

- Call us to find out more

Here are some of the ways BioSig-ID helps you with Academic Fraud

Don’t forget, this is also part of the new 2019 re-authorized Education Act regs: Passwords and proctoring are no longer acceptable for ID verification. A snapshot of what BioSig-ID is/does with over 1M users in 95 countries

- NO hardware or software downloads

- Integrated within your learning management system

- Accreditation proven compliance

- Only the registered student can verify their identity before any gateable event

- Impostors can’t duplicate how the password is DRAWN

- Sharing of passwords and impostor login is no longer possible, academic cheating is eliminated

- Real-time notifications to the school of possible attempted cheating by students

- We have time and attendance capture to catch scammers

- Less invasive, less liability and greater accuracy than other biometrics

- BioSig-ID even offers a web-based contest to duplicate a password” Mom”. We show how it looks, yet 19,000 attempts have failed to duplicate how it was written

Summary:

Financial Aid Fraud and Accreditation for student ID verification is required, are two of the most pressing issues facing your institution. Now you can choose one solution for both – BioSig-ID. We use the same technologies to find fraudsters in both areas.

Once in use, BioSig-ID forensics system knows exactly who students are. It can track many factors from login patterns and attempts to activity and success rates. BioSig-ID finds the anomalies that could never be detected by an individual, or even a dedicated fraud prevention team and provides alerts in real-time. Once the bad actors are found, clients can handle it from there or our dedicated team with decades of experience will do all the work for you.

You don’t want your institution or your name associated in the news announcing Improper payments or a cheating ring. You need to be in compliance. We have the answer to both! Give us a call at 877-700-1611 or schedule a web demo here.

References:

- 1 United States Dept of Education Investigative Services, Sept. 26, 2011, Memorandum. Page 6-10 https://www2.ed.gov/about/offices/list/oig/invtreports/l42l0001.pdf

- 2 https://www2.ed.gov/about/offices/list/ocfo/fipao/fsaimproper18.docx.pdf Federal Student Aid FY 2018 Non-Statistical Improper Payment Estimation Methodology

- 3 Owen, Robert S. (2016) “Cheating in Online Courses for Financial Aid Fraud in the U.S.,” Administrative Issues Journal: Vol. 6: Iss. 2, Article 9. Available at: https://dc.swosu.edu/aij/vol6/iss2/9

- 4 Final Audit Report, U.S. Department of Education Office of Inspector General, Title IV of the Higher Education Act Programs: Additional Safeguards Are Needed to Help Mitigate the Risks That Are Unique to the Distance Education Environment Final Audit Report ED-OIG/A07L000.